Wave: Small Business Software Wave Financial

Here are some of the benefits of paying for accounting software. The platform is easy to use, with customer service provided by the company. Our unbiased reviews and content are supported in part by affiliate partnerships, and we adhere to strict guidelines to preserve editorial integrity. The editorial content on this page is not provided by any of the companies mentioned and has not been reviewed, approved or otherwise endorsed by any of these entities. We spend hours researching and evaluating each accounting software system we review at Merchant Maverick, placing special emphasis on key characteristics to generate our ratings.

See all Wave app features

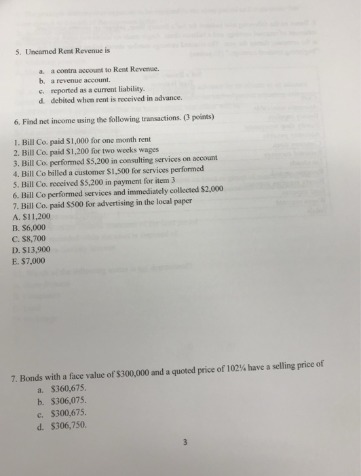

Xero’s cheapest plan starts at $15 a month and limits you to sending just five invoices a month. With a rock bottom score (0/10) for advanced features, the software lacks a number of basic accountancy capabilities, including stock tracking, project accounting, or budget and forecasting. This means that if you have specific needs it’ll make more sense to fork out for paid alternatives, like Xero or QuickBooks. If you’re looking to gain a firmer grasp of your business’s finances, Zoho Books offers excellent budget management features for as low as $15 per month.

Make tax time work for you

Only integrates with in-house apps, like Wave Payments and Wave Payroll; does not integrate with card readers for in-person payments. 4.4 out of 5 stars based on user reviews collected by G2Crowd as of January 2024. After creating your account, everything is set up so you can get started. Your data is always available, and backed up for extra peace of mind. “Wave invoicing makes your life a whole lot easier and takes that worry off you. I’ve tried Quickbooks—it’s a bit more complicated and technical, and takes more time to set up.” Woodard noted that while the profession is currently riding this M&A wave, it cannot last forever.

Invoice on-the-go and get paid faster

See our step-by-step guide on how to import bookkeeping data into Wave here. Transactions will appear in your bookkeeping automatically, and you’ll say goodbye to manual receipt entry. With the Pro Plan, automatically import, merge, and categorize your bank transactions. It’s always available, and it’s backed up for extra peace of mind. Have an eye on the big picture so you can make better decisions. Our accounting reports are easy to use and show monthly or yearly comparisons, so you can easily identify cash flow trends.

If you need to manually edit, add or remove any transactions, you can do so on the Reconciliation or Transactions pages. Next, you can add sales tax (if necessary), create customer profiles and customize your invoice templates. Wave is cloud-based, so you can securely access your accounting software and your financial information anywhere you are—whether you’re working in your pjs, https://www.business-accounting.net/what-does-tax-liability-mean-is-that-the-amount/ or waiting for a meeting to start. You can also choose from Wave’s selection of professional invoice templates to make sure every touch point instills client confidence in your brand. We provide different levels of support, depending on the plan and/or the add-on features you choose. Create beautiful invoices, accept online payments, and make accounting easy—all in one place.

When it comes to integrations, Wave is pretty limited, although it does support a much-needed Zapier integration, which connects Wave with 1,000+ add-ons. The integrations Wave directly connects with are PayPal, Etsy, and Shoeboxed. You can also use the Checkouts feature to create buttons on websites, such as Wix, Squarespace, and WordPress.

In our Wave Accounting review below, we’ll cover Wave’s features, add-ons, pros and cons to help you decide. Wave Accounting does a lot for the price—but it can’t do everything. For instance, it doesn’t offer the same built-in time-tracking and project-tracking features you get with most other basic accounting software plans. Unlike with QuickBooks, you can’t manage 1099 contractors with Wave (which is one reason Wave’s better suited to 1099 contractors rather than those who employ them). Wave offers unlimited income and expense tracking capabilities, which is almost unheard of for free accountancy software. Businesses can link their bank accounts to the platform, import bank statements, and add expenses manually.

Plus, thanks to its integration with the budget-friendly Wave Payroll solution, Wave Accounting can also work well for small businesses with employees. Since the paid version of the software allows for multiple users, it may also appeal to midsize and growing businesses where more than one person keeps an eye on company finances. While Wave Payroll doesn’t have many unique perks that set it apart from the competition, it’s a good option for business owners who are already familiar with Wave Accounting’s interface. Like Wave Accounting, Wave Payroll is extremely intuitive and user-friendly, so you won’t have to worry about navigating a new software system while dealing with the complexities of making your first official hire. Wave’s invoices are easy to customize with your business’s logo, colors and contact information. Until recently, Wave was best-known for its completely free accounting solution.

- And it’s worth noting that while Xero has more features, the software also has a steeper learning curve than Wave.

- You can check out our comparison table to see how Wave compares against the top accountancy providers, too.

- Since you’re self-employed you don’t have the resources of a large company to make sure you’re paid properly and your books are balanced.

- You’ll need to answer a few questions about your business and provide us with a little more information about yourself in order to get approved to accept online payments.

The rate that you charge for your freelancing services can vary, so it’s important to get a grasp of market trends before sending your clients an invoice or quoting a price. Freelance rates can differ depending on experience level and industry. For example, the rate a freelance https://www.wave-accounting.net/ web developer charges may be different than that of a freelance graphic designer, because each freelancer specializes in a different area. I look at the dashboard and know how many invoices are on the way, when they should be paid, and the average time it takes someone to pay.

It can help you manage your bookkeeping, accounting and invoicing processes through a few internal integrations. Wave Accounting is ideal for micro businesses with fewer than 10 employees, contractors, freelancers and other service-based businesses on a budget. The financial management software is user-friendly and equipped with all the basics, including income and expense tracking, invoicing how to void a check and reporting. Create beautiful invoices, accept online payments, and make accounting easy—all in one place—with Wave’s suite of money management tools. With Wave’s web-based invoicing software, you can create and send invoices for your business in just a few clicks from your computer. If you’re on-the-go, you can also send invoices from your phone or other mobile device using the Wave app.

The free plan is capped at one user, with one additional accountant allowed access to the data. The company also offers good customer support options, including an accounting guide, to help you learn to balance the books and use the software. In contrast to Wave and its competitors, Xero includes inventory management with every plan, even its cheapest plan. Businesses that sell products can track them more easily — and for a much lower starting cost — with Xero than they can with QuickBooks, FreshBooks or Wave.

Akaunting may offers deals that drop those prices as much as 60%. Still, if you’re interested in paid accounting software and still want to cut down on costs, FreshBooks’ 50% off deal from $7.50 per month may be your best bet. With Wave, you have access to expense tracking, bank reconciliation, and reporting to help you manage your finances. Wave also has some of the most appealing invoices on the market. Wave also offers time-saving automations, such as recurring invoices, automatic billing, and receipt scanning.

Additionally, QuickBooks does not have a free plan like Wave, with prices starting at $30/month. In the past, Wave generated revenue from its credit card processing, Wave Payroll, and bookkeeping services. While Wave’s free accounting software doesn’t limit you to a certain number of invoices, customers, or transactions, certain features and automations are now only available by subscribing to Wave Pro. There are no trials, subscriptions, or hidden fees.Wave’s optional paid features include online payment processing, payroll software, and access to personalized bookkeeping services and coaching through Wave Advisors. If you’re interested in using payroll software, you can start a free 30-day trial when you sign up for Wave.

Wave is cloud-based software that boasts a solid set of accounting features suitable for most small businesses. In our last review, we found these features especially appealing because they were all completely free with no artificial limits. Unfortunately, Wave has recently updated its pricing model to now include a paid plan. Now, many standard features (such as automatic importing of bank transactions) are only available if you purchase a monthly or annual plan. Additionally, your cost may rise with add-ons like payroll, payment processing, or professional bookkeeping services.

Wave is designed specifically for small business owners to use, no matter what kind of bookkeeping background they come from. The software supports multiple companies and offers personal accounting as well. Wave improved its software and has addressed many customer complaints in its latest redesign, including adding 1099 payroll support, duplicate transaction management, and cash-basis accounting. The checkout feature is one-of-a-kind and a great addition for business owners who need to charge multiple customers quickly. Wave Accounting gives you free unlimited invoices, users, expense and income tracking, credit and bank account connections, and more. It also offers multi-business management for no additional fee.