Walmart Shareholders Deny Proposals On Associate Pay, Safety & Equity

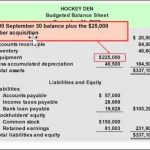

The result represents the amount of the assets on which shareholders have a residual claim. The figures used to calculate the ratio are recorded on the company balance sheet. The equity of a company is the net difference between a company’s total assets and its total liabilities. A company’s equity, which is also referred to as shareholders’ equity, is used in fundamental analysis to determine its net worth. This equity represents the net value of a company, or the amount of money left over for shareholders if all assets were liquidated and all debts repaid. Equity is an important concept in finance that has different specific meanings depending on the context.

Walmart Shareholders Deny Proposals On Associate Pay, Safety & Equity

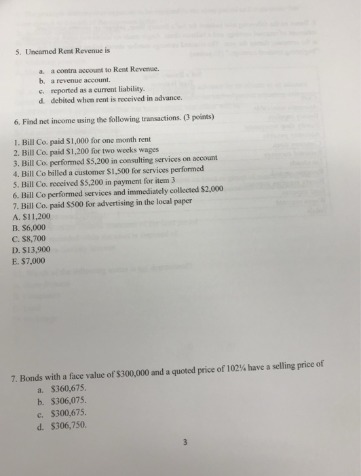

Current liabilities are debts typically due for repayment within one year, including accounts payable and taxes payable. Long-term liabilities are obligations that are due for repayment in periods longer than one year, such as bonds payable, leases, and pension obligations. Including preferred stock in total debt will increase the D/E ratio and make a company look riskier.

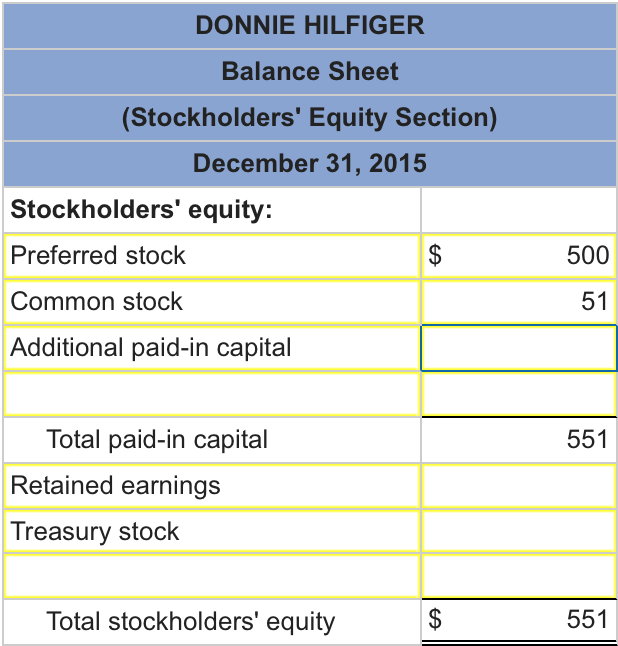

- Shareholder equity can also be expressed as a company’s share capital and retained earnings less the value of treasury shares.

- It indicates the portion of assets that belongs to shareholders instead of creditors.

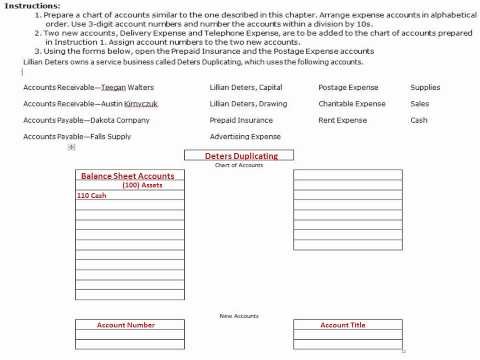

- Here’s an overview of what you may find in the assets and liability sections of the balance sheet.

- Stockholders’ equity (also known as shareholders’ equity) is reported on a corporation’s balance sheet and its amount is the difference between the amount of the corporation’s assets and its liabilities.

How Can the D/E Ratio Be Used to Measure a Company’s Riskiness?

Debt-financed growth may serve to increase earnings, and if the incremental profit increase exceeds the related rise in debt service costs, then shareholders should expect to benefit. However, if the additional cost of debt financing outweighs the additional https://gruppo8.org/category/uncategorized/ income that it generates, then the share price may drop. The cost of debt and a company’s ability to service it can vary with market conditions. As a result, borrowing that seemed prudent at first can prove unprofitable later under different circumstances.

Formula and How to Calculate Shareholders’ Equity

After accounting for debts and obligations, it represents the company’s net worth and ownership stake. Stockholders’ equity can be a key indicator of a company’s stability, growth potential and ability to attract investments. To see how this is calculated in practice, here’s an example of what a hypothetical company’s balance sheet might look like, including assets, liabilities, and stockholders’ equity. The formula to calculate shareholders equity is equal to the difference between total assets and total liabilities. If shareholders’ equity is positive, that indicates the company has enough assets to cover its liabilities. But if it’s negative, that means its debt and debt-like obligations outnumber its assets.

Is Stockholders’ Equity Equal to Cash on Hand?

Perhaps the most common type of equity is “shareholders’ equity,” which is calculated by taking a company’s total assets and subtracting its total liabilities. Private equity is often sold to funds and investors that specialize in direct investments in private companies or that engage in leveraged buyouts (LBOs) of public companies. In an LBO transaction, a company receives a loan from a private equity firm to fund the acquisition of a division of another company. Cash flows or the assets of the company being acquired usually secure the loan. Mezzanine debt is a private loan, usually provided by a commercial bank or a mezzanine venture capital firm.

What is Shareholders Equity?

It also reflects a company’s dividend policy by showing its decision to pay profits earned as dividends to shareholders or reinvest the profits back into the company. On the balance sheet, shareholders’ equity is broken up into three items – common shares, preferred shares, and retained earnings. Many investors view companies with negative shareholder equity http://www.katemaltby.com/category/politics-comment/page/10/ as risky or unsafe investments. But shareholder equity alone is not a definitive indicator of a company’s financial health. If used in conjunction with other tools and metrics, the investor can accurately analyze the health of an organization. For this reason, many investors view companies with negative shareholder equity as risky or unsafe investments.

U.S. IPO Weekly Recap: Healthcare Software Leads $1.3 Billion IPO Week, Even As Novelis Calls Off IPO

The total liabilities referenced in the above formula represent all of a company’s current and long-term liabilities. Short-term debts generally fall into the current liabilities category, as these are things that a company is most likely to pay in the near future. The stockholders’ equity statement informs financial statement users, such as investors https://dndz.tv/dosug/index.php?cat=5cat_1=4id=678&cat_1=14&p=21&id=353 and analysts, about equity-related activity. It aids in evaluating the company’s financial ratios, fund sources and uses and overall financial progress. It involves subtracting total liabilities from total assets using the balance sheet. Paid-in capital is the amount of money shareholders have invested in a company by purchasing its shares.